| Mayor staffer June 1 (evening) Facebook text | LBREPORT.com says |

|---|

| "I wanted to state the reasons I think everyone should support Measures A and B, a temporary sales tax increase in Long Beach, and some answers to some of the most common arguments against it I am hearing. Would love to discuss with anyone on the fence, or opposed but still open." | Regarding discussion, Mayor Garcia has for weeks avoided debating or participating in any forum where he had to face a skilled, informed opponent, apparently preferring one-sided meetings, social network blurbs and surrogates. |

| "1. It's temporary. After six years, it goes from one penny to half a penny, and after ten years it ends. Don't believe people who say 'it will become permanent'. It can't! The sunset is written into the law. No taxes can be passed in California without voter approval. Any tax beyond this temporary one would mean a whole new ballot measure going to voters. The tax is temporary." | Mayor Garcia hasn't publicly stated any coherent plan for reducing City Hall's current spending that would ensure the tax will be "temporary." Labeling the tax "temporary" is a lure glued onto the measure after it tested positively in police/fire union funded polling. The tax can indeed be extended with voter approval that the next Mayor and Council will almost certainly seek to avoid cuts because our current Mayor and Council (who will have moved on in six years) haven't explained what they will do to reduce the City's current spending practices. |

| "2. We need to fix our streets and sidewalks. We have relied for much of that funding on state and federal monies that have diminished lately. We have also relied on oil revenue, which has dropped dramatically - from 100/barrel to less than 35! And many investments lost value in the recession (it happened to everyone). We need to replace that revenue.

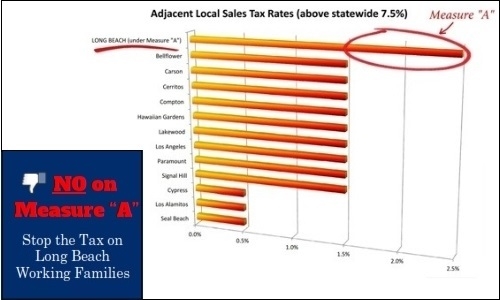

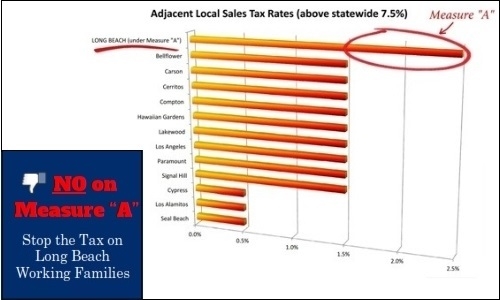

If we don't fix our streets now, we will have to fix them later - at much greater cost." | Other surrounding cities (including Signal Hill & Lakewood) provide their taxpayers with adequate (or better) streets and sidewalks with a 9% sales tax (and 8% in most OC cities.) The threshold question for LB taxpayers should be: why can't LB's Mayor and Council do what other cities can? Long Beach deserves better than a "can't do" Mayor and Council; passing Measure A will enable them to continue their current costly practices. LB taxpayers also deserve to know -- before City Hall demands higher taxes -- if a scandal belatedly uncovered in one Dept. of Public Works infrastructure spending program may reflect a similar culture in other City Hall spending. |

| "3. The City has made HUGE cuts to balance our budget - more than 700 positions in a decade were eliminated. $150 million cut from the budget. This Mayor and Council have been fiscally responsible." | As a voting Councilmember, Garcia and Council incumbent Austin voted (Nov. 2013) to hand up to 15% raises over three years to city management. Their votes now cost LB taxpayers roughly $1.7+ million per year that's not available for infrastructure, police or fire services. Many of the 700 positions "cut" were unfilled "ghost" positions. Other cities weathered "the Great Recession" without cutting 20% of their police officers (including the field anti-gang program) and erasing fire engines (the only apparatus capable of spraying water to put out fires.) |

| "4. The city has achieved historic pension reform. Employees now pay the highest legally allowed amount into our pensions, and the city pays the minimum allowed. Police and fire came to the table and agreed to pension changes even though they legally did not have to. We are saving more than $250 MILLION over ten years due to pension reform. | City Hall implemented overdue pension reforms -- advocated for years by the LB Taxpayers Ass'n which opposes Measure A -- after City Hall gave police and fire unions unsustainable raises (2007/2008) without pension reforms. The raises now used to pay a larger portion of the police and fire pensions, which will save money over time. All of City Hall's public employee unions are currently poised to negotiate new contracts after the election on Measure A, whose revenue the Council can spend for union-sought raises (instead of infrastructure and the like); LB's police and firefighter unions were Measure A's largest single financial contributors in April and through much of May. |

| "5. This tax has NOTHING to do with the new Civic Center. The Civic Center is being paid for from existing revenue! It's already budgeted. That money came from what was being used to maintain the current Center, and from what will be generated by a public-private partnership. It could not have been used for fixing streets and sidewalks! It also has nothing to do with the courthouse, which was a state project with no city involvement in the financing whatsoever." | The unwise and unnecessary Civic Center rebuild will be paid for from 40+ years of future revenue that no one can be certain will be available. The Mayor/Council imposed the transaction without a vote of the people despite taxpayer objections and a refusal to seek bids for a less costly City Hall seismic retrofit. Although the future payments are "budgeted," this doesn't explain how LB taxpayers will pay in future years for the generous annual CPI inflator for the developer/operator which the Council included. The new Civic Center, benefiting a few downtown blocks, will be paid for by taxpayers citywide, draining millions over time from LB's General Fund that won't be available for LB's future police, fire and infrastructure needs. City Hall wrote Measure A in a way that does in fact let current and future Council spend Measure A to pay for or "backfill" sums that the new Civic Center will drain off. |

| "6. The City will use this new revenue for exactly what it is meant for: streets and sidewalks, and to hire more police and fire fighters to replace retiring police and fire fighters. How do I know? The City Council adopted a resolution saying so. There's a Citizen Oversight Committee. The Mayor is staking his reputation on keeping this promise. The auditor will publish audits. And, there really isn't much of anywhere else to spend this much money. Public safety makes up about 3/4 of our budget! Streets and sidewalks cost $40-60 million a year...The money is for infrastructure and public safety. | The Mayor and Council could have legally guaranteed taxpayers police, fire and infrastructure items using the CA constitution's Prop 13/Prop 218 process. They refused. Measure A's text doesn't mention public safety or infrastructure or guarantee any specifics. Measure A is legally a blank check enabling any general fund items that current and future Mayors and Councils desire. The Council "Resolution" is non-binding and can be ignored the day after the election. The Mayor/Council already made their reputations by approving a misleading ballot title and text for Measure A to try and trick voters into thinking it will guarantee police fire and infrastructure which it doesn't do. The City Auditor has no legally specified duties in Measure A although Mayor Garcia included misleading text implying that it does so in his ballot argument to LB voters. |

.

| "7. The Belmont Pool is being paid for mainly by Tidelands funds which can only be used in the coastal area, basically south of Ocean. That money CANNOT BE USED for fixing streets or public safety throughout the city." | The $100+ million Belmont Pool isn't being built yet because it isn't paid for (although partial funding has been set aside); current Tidelands funds don't suffice; if oil prices rise, that may change, but if that doesn't happen, the City could "borrow" general fund money or simply spend general fund money outright for the pool which a Council majority could legally use Measure A funds to do so. |

| "8. The tax is not levied on groceries, medicine, or utility bills." | Thanks a load. And for the record, in Nov. 2008, LB voters voted to extend LB's current utility tax on telephone users to "new methods of telecommunications," You're welcome. |

| "9. Medical marijuana is not going to pay for these needs. The most generous estimates of what the City would generate off a cannabis tax say we'd get about $2 million a year - and that's before any added costs of enforcement. It's less than 4% of what this measure should produce - ie: not nearly sufficient. | Point as stated appears to be well taken. [Side note: Mayor Garcia was among Council majorities that pushed LB into adopting a failed marijuana ordinance that ended up costing LB taxpayers major sums that smarter cities avoided.] |

| "10. The tax is shared by the many visitors to this city - tourists, conventioneers, people who work here but live elsewhere." | Visitors are a fraction of those of us who live here and will pay the tax every day, not just when they visit for a few days. |

| "11. Voters haven't approved a city tax increase for more than 35 years. But, we did cut the utility tax in half a decade ago." | Blaming LB taxpayers isn't smart. To see what happened when the City Council voted to impose a 16% business license surcharge (without bothering to put it on the ballot) that promised multiple major infrastructure traffic items, see LBREPORT.com coverage here. |

And finally: LBREPORT.com provides our Editorial reasons on the merits to vote NO on the Measure A sales tax hike -- to build a better Long Beach -- at this link.

LBREPORT.com will provide LIVE coverage election returns starting shortly after 8:00 p.m. on June 7.