| (June 29, 2012) -- As seen LIVE on LBReport.com this morning (June 29), Congress has voted -- House of Representatives and Senate -- to approve a package of bills that includes flood insurance legislation that does not empower FEMA to impose mandatory flood insurance in areas of low flood risk, protected by levees, at so called "residual risk."

The House passed the Flood Insurance, Transportation and Student Loan package on a 373-52 margin. The Senate passed the measure (beating back some points of order raised to try and prevent the vote) 79-19.

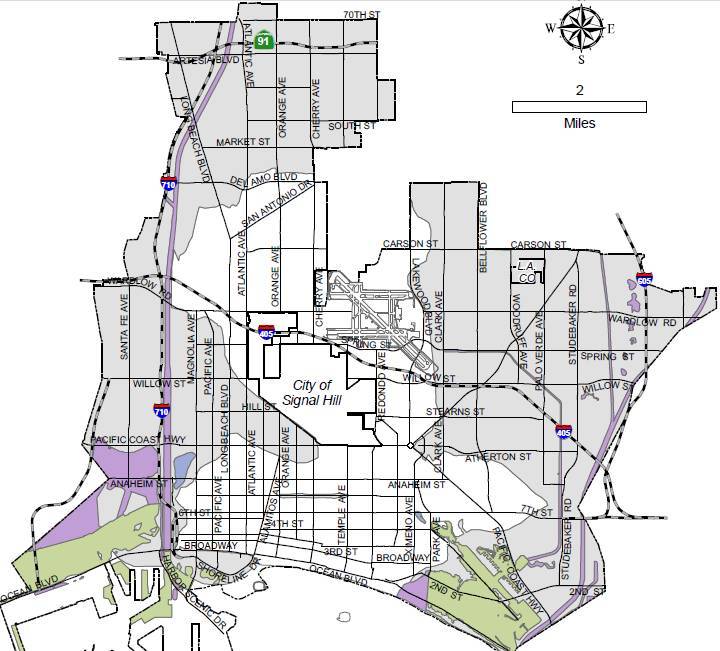

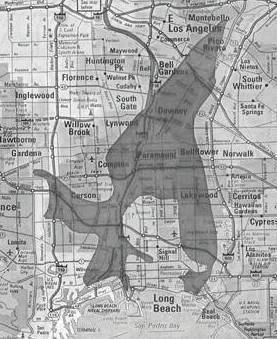

If the flood insurance bill had passed as initially introduced, it would have empowered the Federal Emergency Management Agency (FEMA) to require homeowning families and commercial property owners (with mortgages/loans on their properties from federally backed lenders) to purchase FEMA-administered "flood insurance." That could affected homeowners and commercial property owners in large parts of Long Beach and much of southeast Los Angeles County, currently at low flood risk protected by L.A. river levees (shaded areas in maps below).

The original version of the bill -- with the "residual risk" language included -- was supported earlier this week by the Obama administration's Office of Management and Budget. Premiums harvested from low risk areas would have been harvested to pay flood damages mainly to high risk areas across the country.

In 2011, as reported (first again) by LBReport.com, the House of Representatives voted to remove the "residual risk" language in a last minute flood amendment...but the Senate version of the bill retained the "residual risk" language and made it out of the Senate Banking Committee, advancing nearly to the point of a Senate floor vote.

Some Senators objected, led by Senator Mark Pryor (D., Arkansas) (photo right) and Senator John Hoeven (R., North Dakota), who sought to strike the residual risk language entirely. Their efforts gained the support of big-state Senators including Dick Durbin (D., IL) and Pat Toomey (R, PA) who spoke on the floor in support of the amendment. Senator Pryor's office told LBReport.com at that time that Senator Feinstein supported their amendment.

In a release following today's vote, Senator Pryor's office quotes Senator Feinstein as saying, "I am pleased the residual risk provision was stripped from the flood insurance bill. Dozens of cities and counties throughout California argued vocally against this provision. Their message was clear: it is unfair to penalize homeowners by forcing them to pay for flood insurance after they have already contributed to building safe levees," Sen. Feinstein said.

Senator Pryor said in the release:

In Arkansas and throughout the country, communities have gone to great lengths to build and maintain sound flood control infrastructure. We have some of the best levees in the world that have never once been breached. It simply doesn’t make sense to ignore these taxpayer investments, and arbitrarily force these families to fill FEMA’s coffers through an unnecessary flood insurance mandate...I was proud to go to battle for these communities, and I am hopeful we have put this proposal to rest for good.

Senator Hoeven said in the release:

In North Dakota, no fewer than 17 communities have invested literally hundreds of millions of dollars to protect themselves and their property with dikes, levees and other flood protection infrastructure...We worked very hard in a bipartisan way to amend this bill so that it works well for North Dakota and other states that have already built, or plan to build, extensive flood protection to safeguard their homes and businesses. I appreciate working with Senator Pryor on this amendment, and also want to express my thanks to Senator Toomey for all his good work to secure passage.

The release says that joining Senators Pryor, Hoeven, Toomey and Durbin (D-IL) were Senators Mark Begich (D-AK), Jeff Bingaman (D-NM), Roy Blunt (R-MO), John Boozman (D-AR), Richard Blumenthal (D-CT), Bob Casey (D-PA), Thad Cochran (R-MS), Kent Conrad (D-ND), John Cornyn (R-TX), Dianne Feinstein (D-CA), Al Franken (D-MN), Kay Bailey Hutchison (R-TX), James Inhofe (R-OK), Johnny Isakson (R-GA), Frank Lautenberg (D-NJ), Jeff Merkley (D-OR), Claire McCaskill (D-MO), Pat Roberts (R-KS), and Debbie Stabenow (D-MI).

As first reported yesterday (June 28) by LBReport.com, LB City Manager Pat West informed Councilmembers at 2:00 p.m. Pacific time (June 28) that all "residual risk" language has been stricken from House-Senate conference committee agreed text. The turn of events was far from certain earlier in the day.

Senate Majority Leader Harry Reid (D., NV) announced at the beginning of the day's session that the flood insurance bill, and two other bills (transportation and student loans) would be voted on a single package...making it impossible for Senators to make amendments, giving them only an up-or-down vote on a conference (House-Senate) agreed version of the bills.

Through midmorning and into the afternoon, there was serious doubt as to whether the amendment to strike the "residual risk" language would come to a vote. It wasn't until yesterday (June 28) that it was decided that the final bill language in a House-Senate conference report had deleted the "residual risk" mandatory flood insurance language.

City Manager West's June 28 email advisory -- indicating that the residual risk language has been stricken from a House-Senate conference version of the bill -- credits Mayor Bob Foster for significant efforts as well as the Council's Federal Legislative Committee and city staff [point person was Tom Modica, Director of Government Affairs].

City Manager West's email also singles out the city's DC lobbyist, Thane Young from Van Scoyoc Associates, saying he "deserves a great deal of credit for marshalling the national efforts to strike these provisions from the bill, working directly over the past few days with key Senators to remove the language."

LBReport.com was first to detail the impacts of the advancing legislation in the House last year, and was first to report the bill's advance in the Senate as soon as we learned about it on June 22. We have since learned that Sen. leadership began advancing the measure publicly on June 12. LB's DC legislative advocacy firm mentioned that the Senate's leadership could advance the measure, listing it among multiple Washington developments in a routine periodic legislative update memo on June 5.

City management sent the DC advocate's update memo -- without drawing any special attention to the flood insurance legislation -- to the Council's Federal Legislation Committee (DeLong, Garcia, Gabelich), cc'd to Mayor Foster and Councilmembers on June 18.

On June 22, LBReport.com learned [through a source outside Long Beach] that the flood insurance bill was advancing in the Senate and we immediately began continuing, detailed coverage of the story.

On June 24, Councilwoman Gerrie Schipske sent a mass email citing our reports. That resulted in nearly a hundred emails [that we know about] to Senators Boxer and Feinstein.

On June 27, Supervisor Don Knabe's office sent an email describing the seriousness of what was taking place.

The latest development as of [the morning of June 27] on the flood insurance bill is that Senator Shelby from Alabama has apparently developed a plan to attach the Senate substitute bill (attached) to a pending bill that would combine the transportation reauthorization bill and a bill to extend the student loan interest rate subsidy.

This would be a very disturbing development from the County’s point of view because, unlike the transportation and student loan components, which expire on June 30, the flood insurance program authority runs until the end of July.

Had the Senate flood insurance bill come up under regular order, there is a pending amendment by Senators Pryor, Feinstein and others to change the residual risk provision in a way that levels the playing field for California by continuing current policy that eliminates the need for mandatory flood insurance for areas protected by levees, dams, or flood control facilities.

The Shelby language upsets this balance by potentially making communities protected by levees and other facilities subject to mandatory insurance, a major departure from the current policy that is working fine.

Because of the urgency of the situation and its impact on the County and California, public officials have been asked to contact Senator Boxer directly to oppose attaching the flood insurance reauthorization to the transportation/student loan bill.

and...

Forgive this combined email, but we have been asked if any of our Board members would be willing to contact Senator Boxer directly regarding the pending flood insurance bill. Details are below (including contact information). Because Supervisors Ridley-Thomas and Knabe raised concerns with our Senators about the flood insurance bill, it would be appropriate to contact senator Boxer to express the County’s opposition to attaching the flood insurance bill to the transportation bill as well as supporting the amendment by Senator Pryor of Arkansas to remove language on residual risk that would be damaging to California communities. We have been told that other California jurisdictions will also be reaching out...

The bottom line: as of 11:11 a.m. Pacific time on June 29, a legislative attempt by some in Washington to empower FEMA to impose mandatory flood insurance in areas of so-called "residual risk" is gone...for the moment.

There's still further on this story. Watch for it separately on LBReport.com...where you don't miss a thing.

Advertisement:

See VIDEO of our dog -- before and after -- wash & trim at Wags to Whiskers (LaunderPet)

|

Return To Front Page

Contact us: mail@LBReport.com

|