(June 23, 2012, 7:45 a.m., updated June 25, 3:15 a.m.) -- The Senate version of a bill that could require property owners carrying federally backed mortgages in much of LB and southeast L.A. County to pay annual FEMA-mandated "flood insurance" premiums (within a federally decreed "residual risk zone" from recently upgraded L.A. river levees) could cost homeowners and business property owners a currently unknown amount, along with annual increases.

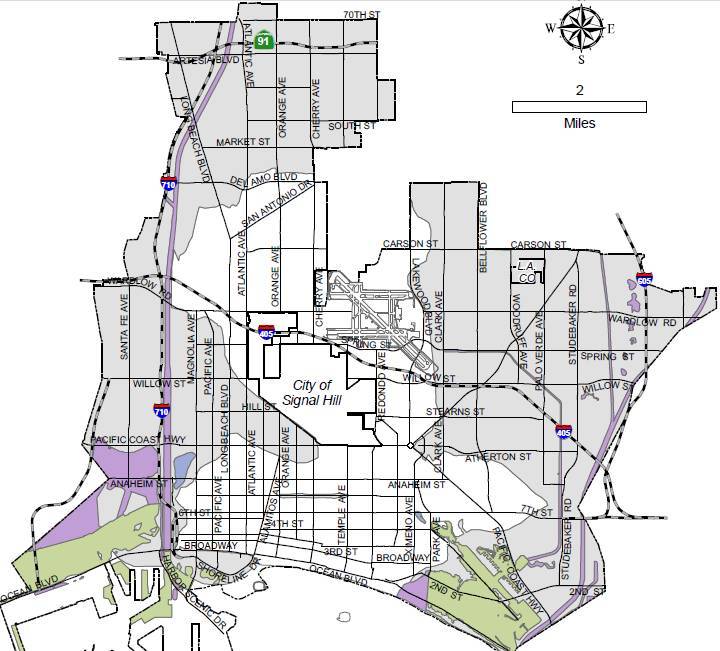

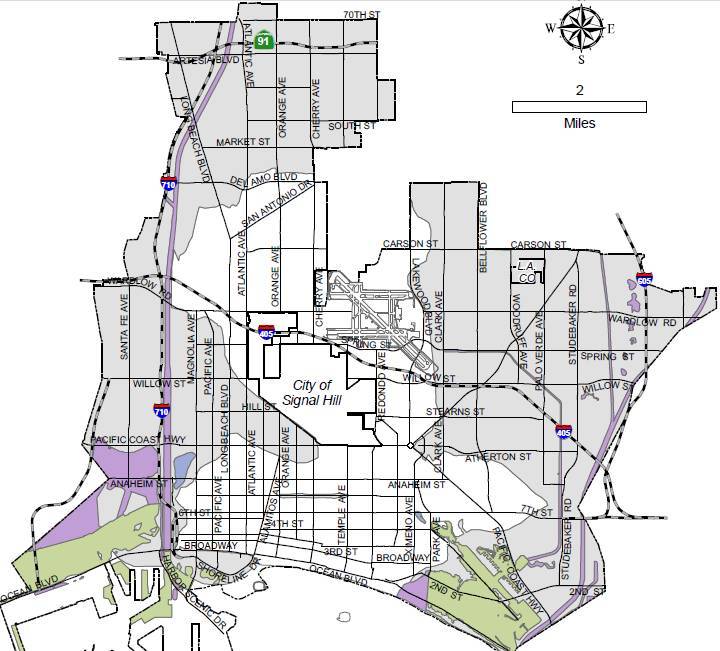

Gray portions on City of LB map show areas within Long Beach that in the 1990s FEMA declared at "100 year" flood risk (which was eliminated by upgrading the L.A. river levees). The bill would direct FEMA to collect flood insurance premiums from areas it now calls at "residual risk" of flooding, a supposed "500 year" or 0.002 annual risk,

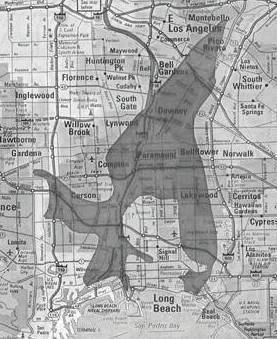

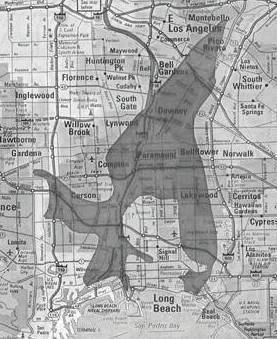

The broader southeast L.A. County area now potentially impacted by the pending Senate "residual risk" legislative language is the shaded area on the map below that unofficially shows FEMA's previous 100-year mandatory flood insurance area removed by taxpayer-funded levee and bridge upgrades in the late 1990s-early 2000s.

At the time, officials estimated roughly 400,000 local residents and 125,000 structures were required to pay FEMA's costly annual flood insurance premiums until the levee upgrades were completed,

While the precise out-of-pocket costs for property with those now with federally backed mortgages isn't known or knowable from the Senate bill's text, some area homeowners currently within 100 year-flood zones are required to pay several hundred dollars a year approaching or exceeding roughly $1,000 annually [caveat: depends on multiple variable factors]. The now pending legislation says the price of flood insurance policies in so-called "500 year residual risk" zones must "accurately" reflect the flood protection level provided by levees, dams the flood control system...but leaves that process to FEMA which stands to collect the premium revenue.

The revenue drained from area property owners and the resulting negative economic impact to the area, is among the bases cited by LB Mayor Bob Foster last year (text below) in urging CA's two U.S. Senators, Barbara Boxer and Dianne Feinstein, to remove the "residual risk" verbiage from the bill...which didn't happen.

The U.S. Senate floor session at which the bill could come up, and potentially be subject to amendments and other votes, is scheduled to begin at 11:00 a.m. Pacific Time. LBReport.com plans to carry LIVE video of the U.S. Senate on our front page: www.LBReport.com.

The measure, reported in detail by LBReport.com last year, began moving again on June 12, when Senate Majority Leader Harry Reid (D, NV) sought to consider S. 1940 on the Senate floor, and made the motion to consider the bill for several days in succession. Finally on June 20, Senator Reid -- with the backing of several Senators including Sen. Barbara Boxer (D., CA), brought a cloture motion to move to the FEMA flood insurance bill. The cloture motion passed 96-2...and the Flood Insurance measure could now be taken up as early as Monday (June 26).

To our knowledge, Long Beach city officials said nothing publicly about these developments. The City pays a private DC legislative advocacy firm, Van Scoyoc and Associates, a six figure sum annually to advise and advocate for the City of Long Beach on pending legislation.

Last year (as previously reported by LBReport.com), LB Mayor Bob Foster sent a letter (text below) to CA's two U.S. Senators, Barbara Boxer and Dianne Feinstein, urging them to urge their colleagues on the Senate Banking Committee to remove the "residual risk" language.

The LB City Clerk's website indicates that the Council's Federal Legislation Committee (DeLong, Gabelich, Garcia) last met in December 2011 when it approved, and sent to the full Council which also approved, a federal "Legislative Agenda" (list of general positions that the City of LB will support/oppose) the following:

Strongly oppose any legislation that would reclassify areas currently protected by recently upgraded, federally certified flood protection levees with no demonstrable history of recent flooding as "residual risk" zones that would be subject to mandatory flood insurance. In such areas locally, require FEMA to meet current requirements for a formal flood insurance study before attempting to rezone as a flood risk area.

Councilman Gary DeLong, who chairs the LB City Council's Federal Legislation Committee (DeLong, Gabelich, Garcia), has travelled to Washington, D.C. several times in 2012. One publicly released itinerary lists the flood insurance issue among a number of items to be discussed during at least one of his DC trips.

As LBReport.com detailed last year, the House version of the FEMA reauthorization doesn't include the "residual risk" language because it was removed at the last-minute via an amendment on the House floor. However the Senate version of the bill does include the "residual risk" language. Section 107 of the Senate bill would for the first time enable FEMA to collect flood insurance premiums from areas at "500 year" flood risk (0.002 annual risk), portrayed as a "residual risk" on grounds the levees or dams (built to end the 100 year risk) might somehow to fail.

The Senate bill's language states in pertinent part:

June 25 UPDATE: subsequent development: See "Compromise" Text Offered By Four Southern Senators On "Residual Flood Risk" From Levees Triggering Mandatory Fed'l Flood Insurance which if accepted by the Senate would replace the earlier text below.

SEC. 107. MANDATORY COVERAGE AREAS.

(a) Special Flood Hazard Areas- Not later than 90 days after the date of the enactment of this Act, the Administrator shall issue final regulations establishing a revised definition of areas of special flood hazards for purposes of the National Flood Insurance Program.

(b) Residual Risk Areas- The regulations required by subsection (a) shall require the expansion of areas of special flood hazards to include areas of residual risk that are located behind levees or near dams or other flood control structures, as determined by the Administrator.

(c) Mandatory Participation in National Flood Insurance Program-

(1) IN GENERAL- Any area described in subsection (b) shall be subject to the mandatory purchase requirements of sections 102 and 202 of the Flood Disaster Protection Act of 1973 (42 U.S.C. 4012a, 4106).

(2) LIMITATION- The mandatory purchase requirement under paragraph (1) shall have no force or effect until the mapping of all residual risk areas in the United States that the Administrator determines essential in order to administer the National Flood Insurance Program, as required under section 118, are in the maintenance phase.

(3) ACCURATE PRICING- In carrying out the mandatory purchase requirement under paragraph (1), the Administrator shall ensure that the price of flood insurance policies in areas of residual risk accurately reflects the level of flood protection provided by any levee, dam, or other flood control structure in such area, regardless of the certification status of the flood control structure.

The language applies nationwide but would have an especially severe impact locally. In the 1990s, FEMA and the Corps of Engineers extrapolated/hypothesized a "100 year" risk if levees along the L.A. and Rio Hondo rivers overtopped and went on to fail. Although the area had never had any flooding from the L.A. River since it was channelized, FEMA bureaucratically designated much of the area as its highest flood risk category -- a "special flood hazard area -- an action that enabled it to could collect annual flood insurance premiums. The Long Beach areas included much of Wrigley, large parts of NLB and a big swath of ELB, and also included large parts of southeastern L.A. County..

Homeowners whose properties carried federally backed mortgages were required to pay hundreds of dollars a year until a federally funded project (expedited by then-Congressman Stephen Horn (R, LB)) upgraded the levees and reconfigured some bridges. That ended the 100 year flood risk and removed the annual flood insurance mandate.

In contrast, the now-pending Senate bill's "residual risk zone" (0.002 annual risk") would empower FEMA to resume collecting flood insurance premiums from the same areas basically indefinitely. The annual premium cost for consumers isn't specified in the bill; it directs FEMA to impose risk based rates that are "accurate" but leaves that process to FEMA (which stands to collect the premium revenue).

The bill is supported by the Obama administration but has bipartisan support. FEMA faces large payouts from events like Hurricane Katrina and other floods, and the legislation spares Congress the need to cover those losses (by shifting the costs to property owners that FEMA claims are at flood risk). Under the now advancing Senate legislation, anyone within in an area that FEMA previously deemed at 100 year flood -- even if now protected by levees and dams to 100 year flood level (0.01 annual risk) -- will now be required to buy FEMA flood insurance if they're within an area deemed at "500 year residual risk" (0.002 annual risk).

In August 2011, Long Beach Mayor Bob Foster sent a two page letter to Senators Barbara Boxer and Dianne Feinstein, asking them to urge their Senate Banking Committee colleagues to delete the residual risk language. That either didn't happen or was unsuccessful...since the "residual risk" language in the bill is now headed to the Senate floor.

Mayor Foster's letter stated in pertinent part:

...I would like to bring your attention to a specific provision...that would adversely impact our residents. While increasing premium rates and ensuring greater participation in the program are essential goals for program reauthorization, the provision related to "residual risk areas" would unnecessarily damage our local and state economies and could actually discourage support for flood protection projects...

[Cites 1991 USC study that concluded property owners would pay $131 million in annual flood insurance premiums prior to mitigating legislation.]...[In the pending legislation] annual insurance premiums would increase to $295 million, based on the Congressional Budget office's estimate of premiums mandated...The economic impact and job losses would certainly be greater than the estimates of 20 years ago. And there would be no opportunity to remedy the situation...

...In addition to the economic impact, such a requirement imposes a major disincentive for local communities to raise funds to improve flood control systems. Why should property owners approve property assessments and bond initiatives to cost-share flood control improvements when insurance premiums would still be collected and building restrictions remain in place once the improvements are completed?

For these reasons, I urge you to raise this matter with your colleagues on the Senate Banking, Housing and Urban Affairs Committee. Not only is residual risk area mapping a concern for the City of Long Beach and other Los ANgeles River cities but also for any community in the country that is protected by levees or dams...I hope that members of the Senate Committee will agree that the economic impacts and the disincentive to flood protection are too great to risk including this provision in the legislation being drafted.

If the "residual risk" language isn't removed on the Senate floor and the bill passes the Senate with that language included, it will go to the House-Senate conference committee (comprised of a handful of members chosen by the House-Senate leadership) who will decide whether the Senate or House language remains in the final bill.

If the Conference committee agrees on a final bill without the "residual risk" language, home and commercial property owners outside the former 100 year flood zone won't be required to buy FEMA flood insurance. BUT if the Conference Committee agrees to a final bill that includes the "residual risk" language, the House and Senate will then have a single up-or-down vote on the final bill...and if it passes, it will go to the White House where President Obama will likely sign it into law...and FEMA will begin the process of extracting mandatory flood insurance premiums for those with federally backed mortgages within the former 100 year flood zone.

Belmont Shore areas which have for years been designated at 100 year flood risk aren't affected by these developments; they've been required to pay annual flood insurance for years based on flood risk from the ocean, not from the L.A. river.

As previously reported by LBReport.com FEMA is also separately moving to designate a NW portion of Long Beach at 100-year flood risk (mandatory flood insurance premiums) alleging deficiencies in Compton Creek's levees (structures belonging to the L.A. County Dept. of Public Works).

Developing...with further to follow, including the U.S. Senate proceedings LIVE on our front page on Monday at 11 a.m. -- on LBReport.com.

Return To Front Page

Contact us: mail@LBReport.com

|