|

See "Compromise" Text Offered By Four Southern Senators On "Residual Flood Risk" Re Levees & Mandatory Fed'l Flood Insurance Potentially affects homeowners/comm'l property owners w/ federally backed loans in parts of LB/southeast L.A. County

|

|

|

See "Compromise" Text Offered By Four Southern Senators On "Residual Flood Risk" Re Levees & Mandatory Fed'l Flood Insurance Potentially affects homeowners/comm'l property owners w/ federally backed loans in parts of LB/southeast L.A. County

|

|

| (June 25, 2012, 3:05 a.m.) -- LBReport.com reports the following at predawn Pacific time Monday June 25.

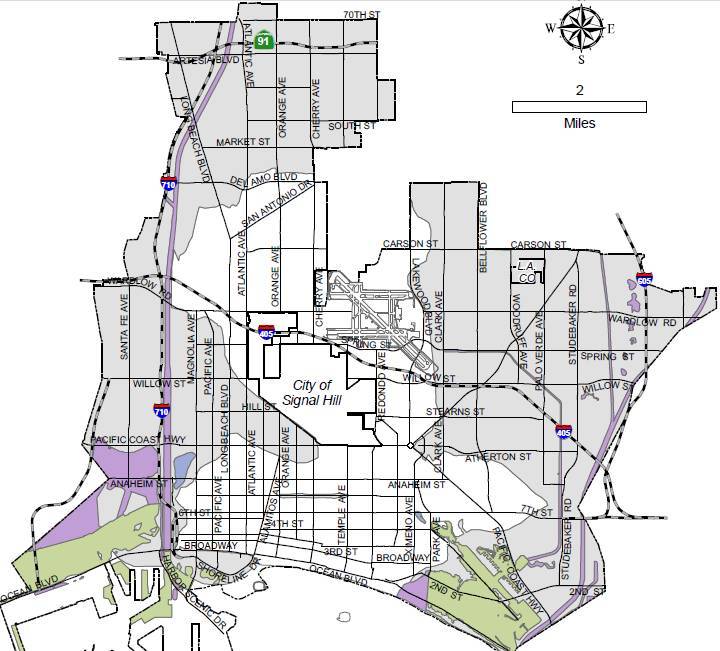

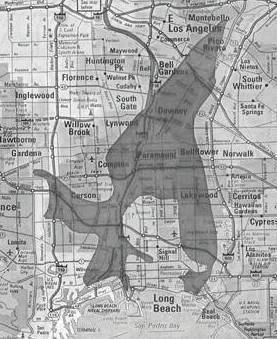

We have obtained from a Washington, D.C. source legislative text that would modify verbiage in the mandatory flood insurance section of a now-pending Senate bill that could require many Long Beach and southeast L.A. County area property owners (with federally backed loans) to purchase federal flood insurance. The bill could declare them at "residual flood risk" of flooding from L.A. river levees that were raised in the late 1990s-early 2000s to protect against flooding. The language is reportedly being circulated as a "compromise" on "residual flood risk" by four southern Senators, they say with agreement by the chair (D) and ranking member (R) of the Senate Banking Committee. The self-described "compromise" by Senators Thad Cochran (R-Miss.), David Vitter (R-La), Mary Landrieu (D-La) and Kay Bailey Hutchison (R-Texas) doesn't eliminate, and arguably institutionalizes, the legislation's entirely new provision that residents in an area protected from a "100 year" (0.01 annual chance) flood by levees and dams will be required to buy flood insurance on grounds they remain at a low "residual" risk from possible levee or dam failure.   The "compromise" also adds some additional technical requirements and necessary administrative findings (not in the original bill) which FEMA must complete before triggering the mandatory insurance provision. The "compromise" also arguably makes it more likely, not less, that the "residual risk" language -- which the House (including Reps. Rohrabacher and Richardson) voted to delete -- will survive a House-Senate conference committee and end up in the final bill sent to the House and Senate for passage. The City of Long Beach's position in its Council-adopted federal legislative agenda (text below) is to oppose any designation of parts of LB at so-called "residual risk" without a formal flood insurance study. In July 2011, the House voted to remove the "residual risk" language entirely from its version of the bill, and in August, Mayor Bob Foster sent a letter asking Senators Barbara Boxer and Dianne Feinstein to urge their Senate colleagues to remove the residual risk language from the Senate version...but that didn't happen. As of predawn today, the text below isn't visible on the Library of Congress official bill webpage. The so-called compromise" text follows: SEC. 107. AREAS OF RESIDUAL RISK. (a) IN GENERAL.—Chapter III of the National Flood Insurance Act of 1968 (42 U.S.C. 4101 et seq.) is amend6 ed by adding at the end the following: ‘‘SEC. 1368. AREAS OF RESIDUAL RISK. ‘‘(a) DEFINITIONS.— ‘‘(1) AREA OF RESIDUAL RISK.—Not later than 18 months after the date of enactment of the Flood Insurance Reform and Modernization Act of 2012, the Administrator shall establish a definition of the term ‘area of residual risk’ for purposes of the national flood insurance program that is limited to areas that— ‘‘(A) the Administrator determines are located ‘‘(i) behind a levee or near a dam or other flood control structure; and ‘‘(ii) in an unimpeded 100-year flood plain; and ‘‘(B) are not areas having special flood hazards. ‘‘(2) OTHER DEFINITIONS.—In this section— ‘‘(A) the term ‘hydrographic subdivision’ means a subdivision of an area of residual risk that is determined based on unique hydro4 graphic characteristics; and ‘‘(B) the term ‘unimpeded 100-year flood6 plain’ means that area which, if no levee, dam, or other flood control structure were present, would be subject to inundation from a flood having a 1-percent chance of being equaled or exceeded in any given year. ‘‘(b) TREATMENT OF AREAS OF RESIDUAL RISK. Except as otherwise provided in this section, this title, the Flood Disaster Protection Act of 1973 (42 U.S.C. 4002 et seq.), and the Flood Insurance Reform and Moderniza- tion Act of 2012 shall apply to an area of residual risk as if it were an area having special flood hazards. ‘‘(c) EXEMPTION FROM FLOODPLAIN MANAGEMENT REQUIREMENTS.—A State or local government with jurisdiction of an area of residual risk (or subdivision thereof) shall not be required to adopt land use and control measures in the area of residual risk (or subdivision thereof) that are consistent with the comprehensive criteria for land management and use developed by the Administrator under section 1361. ‘‘(d) PRICING IN AREAS OF RESIDUAL RISK.—In carrying out section 102 of the Flood Disaster Protection Act of 1973 (42 U.S.C. 4012a), the Administrator shall ensure that the risk premium rate for flood insurance policies for a hydrographic subdivision does not exceed a rate 6 that adequately reflects ‘‘(1) the level of flood protection provided to the hydrographic subdivision by any levee, dam, or other flood control structure, regardless of the certification status of the flood control structure; and ‘‘(2) any historical flooding event in the area. ‘‘(e) WAIVER OF MANDATORY PURCHASE REQUIREMENTS FOR DE MINIMIS RISK.—The requirements under sections 102 and 202 of the Flood Disaster Protection Act of 1973 (42 U.S.C. 4012a and 4106) shall not apply to any property in an area of residual risk for which the risk premium, as established in accordance with subsection (d), is less than the equivalent of $1 per day, as determined by the Administrator. ‘‘(f) DECERTIFICATION.—Upon decertification of any levee, dam, or flood control structure under the jurisdic22 tion of the United States Army Corps of Engineers, the Chief of Engineers shall immediately provide notice to the Administrator.’ (b) DEFINITION.—In this section, the term ‘‘area of residual risk’’ has the meaning given that term under section 1368 of the National Flood Insurance Act of 1968, added by this section. (c) EFFECTIVE DATE FOR MANDATORY PURCHASE REQUIREMENT.—The requirements under sections 102 and 202 of the Flood Disaster Protection Act of 1973 (42 U.S.C. 4012a and 4106) shall not apply to any area of residual risk, until— (1) the Administrator submits to Congress a certification that the Administrator has completed a study of levels of flood risk that provides adequate methodologies for the Administrator to estimate varying levels of flood risk for areas of residual risk; (2) the mapping of all areas of residual risk in the United States that are essential in order to ad17 minister the National Flood Insurance Program, as required under section 118 of this Act, is in the maintenance phase; and (3) in the case of areas of residual risk behind levees, the Administrator submits to Congress a certification that the Administrator is able to adequately estimate varying levels of residual risk behind levees based on (A) the design of the levees; (B) the soundness of the levees; (C) the hydrography of the areas of residual risk; and (D) appropriate consideration of historical flooding events in the areas of residual risk. (d) STUDY AND REPORT ON MANDATORY PURCHASE REQUIREMENTS IN RESIDUAL RISK AREAS.— ... SEC. 108. PREMIUM ADJUSTMENT. Section 1308 of the National Flood Insurance Act of 1968 (42 U.S.C. 4015), as amended by section 106, is further amended by adding at the end the following: ‘‘(h) PREMIUM ADJUSTMENT TO REFLECT CURRENT RISK OF FLOOD.—Notwithstanding subsection (f), upon the effective date of any revised or updated flood insurance rate map under this Act, the Flood Disaster Protection Act of 1973, or the Flood Insurance Reform and Modernization Act of 2012, any property located in an area that is participating in the national flood insurance program shall have the risk premium rate charged for flood insurance on such property adjusted to accurately reflect the current risk of flood to such property, subject to any other provision of this Act. Any increase in the risk premium rate charged for flood insurance on any property that is covered by a flood insurance policy on the effective date of such an update that is a result of such updating shall be phased in over a 4-year period, at the rate of 40 percent for the first year following such effective date and 20 percent for each of the second, third, and fourth years following such effective date. In the case of any area that was not previously designated as an area having special flood hazards and that, pursuant to any issuance, revision, updating, or other change in a flood insurance map, becomes designated as such an area, the chargeable risk premium rate for flood insurance under this title that is pur6 chased on or after the date of enactment of this subsection with respect to any property that is located within such area shall be phased in over a 4-year period, at the rate of 40 percent for the first year following the effective date of such issuance, revision, updating, or change and 20 per11 cent for each of the second, third, and fourth years fol12 lowing such effective date.’’ The City of LB's Federal Legislative Agenda (list of general positions that the City of LB will support/oppose), last approved by the City Council in January 2012, includes the following: Strongly oppose any legislation that would reclassify areas currently protected by recently upgraded, federally certified flood protection levees with no demonstrable history of recent flooding as "residual risk" zones that would be subject to mandatory flood insurance. In such areas locally, require FEMA to meet current requirements for a formal flood insurance study before attempting to rezone as a flood risk area. In a release describing the "compromise," Senator Thad Cochran (R., Mississippi) states in pertinent part: ...Serious concerns over the Banking Committee’s initial treatment of levees, first raised by Cochran and Senator Mark Pryor (D-Ark.) last fall, were considered a major impediment to Senate passage of a long-term reauthorization measure. The original bill failed to give proper credit to federal, state, and local investments in levees and other flood control infrastructure. Watch for further developments on LBReport.com. including the U.S. Senate proceedings LIVE on our front page on TODAY Monday at 11 a.m. -- on LBReport.com.

Contact us: mail@LBReport.com |

Presented by Signal Hill Petroleum (8:00-10:00 p.m.)          Hardwood Floor Specialists Call (562) 422-2800 or (714) 836-7050  |

Contact us: mail@LBReport.com