FPPC ID# 1385812

FPPC ID# 1385812 |

| In our piece below, LBREPORT.com doesn't imply or invite the inference of any ethical impropriety by the City Auditor. However we are disappointed that in our non-auditor opinion, we believe the City Auditor fell short of the level of independence we expect from her office.

(June 1, 2016, 11:10 p.m.) -- What did Mayor Robert Garcia know and when did he know it? And why did LB's City Auditor secretly communicate the seriousness of her office's Audit findings to the Mayor -- who wasn't the Auditee or otherwise a party to the Audit -- before the Audit was completed and released to the public...while the Mayor told taxpayers the City needed a sales tax hike 10% to deal with infrastructure needs? On June 1, LBREPORT.com invoked the CA Public Records Act to seek access to records from the office of City Auditor Laura Doug after she acknowledged in a May 25 email to LBREPORT.com that she had "continually communicated the seriousness" of findings to Mayor Robert Garcia -- before her office made its Audit findings public -- regarding City's Job Order Contracting Program used by the City's Public Works to complete millions of dollars in infrastructure (including repair/renovations of parks, libraries and City buildings.) [Scroll down for further.] |

The Audit, released May 25, concluded that the City's Job Order Contracting (JOC) program within the City's Dept. of Public Works "is not receiving competitively priced projects." The Audit found [Executive Summary text] "a significant systemic lack of controls over all key areas of the process, creating an environment that is highly vulnerable to fraud. Too much emphasis is placed on completing projects quickly instead of ensuring projects are properly defined and competitively priced. This results in projects not having competitive bidding and being priced higher than the City is contractually obligated to pay." In a May 25 email to LBREPORT.com, Ms. Doud indicated that the Audit "took well over a year to complete [and] [d]uring that time, we continually communicated the seriousness" of its findings to the Mayor. Pressed on the timeline -- in which the Audit was released May 25 after a nearly $300,000+ pro-tax-hike campaign with vote by mail ballots circulating since roughly May 9, Ms. Doud told LBREPORT.com in a May 26 email: "Any relationship between this audit and the tax initiative is coincidental as the report was released when it was completed."

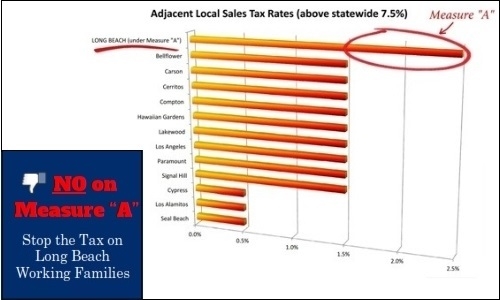

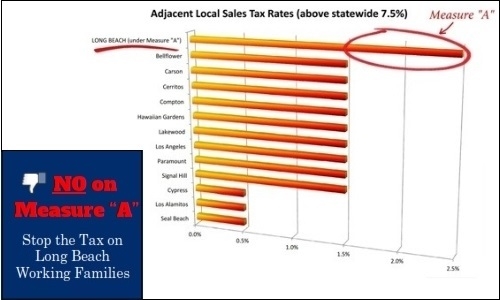

Mayor Garcia has argued that LB's poor infrastructure (potholes, sidewalks and the like) resulted in part from LB voters failing for decades to approve a citywide tax increase. Measure A, placed on the ballot by the City Council by voted actions on Feb. 23 and March 1, would raise LB's sales tax to 10% (currently 9% in Signal Hill/Lakewood, 8% in most OC cities) and would let current and future Councils spend the tax revenue on any general fund items they wish...although Garcia and the Council have said they intend to use the tax money for police, fire purposes and infrastructure purposes. The Audit found that practies the Public Works' Job Order Contracting program within LB's Dept. of Public works cost taxpayers as much as $1.9 million on infrastructure project costs identified during a 17-month Audit period...and since typical JOC projects averaged $100,000, the JOC program's practices meant that as many as 19 additional infrastructure projects could have been completed. On April 5, Mayor Garcia agendized a City Council item that sought changes in the JOC program, portraying it as the result of his having "been working with the City Auditor's office to improve the City's Job Order Contracting Program (JOC)." He told the Council and the public: "We are interested in making changes to improve efficiency and strengthen transparency in our JOC programs." Garcia made no public mention of the not-yet-public audit of the JOC program but asked the City Attorney to prepare an ordinance "for an updated City of Long Beach Job Order Contracting Program and return to City Council for review in 45 days." During that 45 day period, Garcia publicly advocated the sales tax increase ballot measure, contending the City had a backlog of needed infrastructure repairs because the City lacked sufficient revenue. The Job Order Contracting Program is only one part of the Department of Public Works infrastructure projects, and City Auditor Doud hasn't indicated publicly whether the practices she uncovered in the JOC may reflect similar practices elsewhere in the Department...and what steps she plans to take, if any, to take to determine if similar practices may or may not exist elsewhere in the Department with even larger taxpayer impacts. On May 24, an item appeared on the Council agenda to implement changes in the JOC program with no public reference to the then-publicly secret infrastructure related Audit. The next day, on May 25, the City Auditor released the Audit accompanied by a press release but without agendizing it for a City Council presentation (which would have allowed Council questions and colloquy.) The next regularly scheduled Council meeting is June 14...a week after the June 7 election. The May 25 released Audit findings include the following: [City Auditor May 25, 2016 press release text] In December 2014, the City received a letter warning that contractors' bids were too low. However, the City disregarded the warning and continued to accept the low bids. The audit found vague scopes of work (SOW) which lacked sufficient detail to determine if contractor pricing was appropriate. The poorly designed SOWs resulted in change orders and cost overruns occurring in 91% of the projects reviewed during the audit period. To view the Audit in full, click here.

Neither the Audit text, nor the Auditor's press release accompanying it, mention the Auditor's office communications with the Mayor's office. LBREPORT.com learned about the Auditor's communications with the Mayor via an email from City Auditor Doud, which told us: [City Auditor May 25 email to LBREPORT.com]: The audit was lengthy and took well over a year to complete. During that time, we continually communicated the seriousness of the findings to City Management and the Mayor. We have an internal process that ensures an open line of communication throughout the audit and sets expectations to ensure all findings are thoroughly vetted. The internal process, as described on the City Auditor's website, refers to Auditees...but the Mayor wasn't the Auditee. The JOC program within the City's Dept. of Public Works was the Auditee. The City Auditor's website indicates it's the City Auditor's office policy to communicate its findings to the Mayor and Council after the matter is closed out...but since the City Auditor apparently communicated at least some findings on matters related to the Audit to the Mayor before the Audit was closed out. LBREPORT.com asked Auditor Doud to explain what took place. In a May 26 email, she replied in pertinent part: [May 26 email from City Auditor Doud to LBREPORT.com] Inferring that something occurred outside of our normal audit process is incorrect. We do not and have never released findings to the public until they have been fully vetted and reviewed both internally and with Departments. This audit was no exception. To release that information prematurely would be a violation of Government Auditing Standards.

The Measure A tax measure makes no mention of the City Auditor's office, but the City Council approved (Feb. 23, 8-0, Austin absent) a ballot title and text that explicitly mentions "independent audits" [emphasis added by us]: [All caps in original] "CITY OF LONG BEACH PUBLIC SAFETY, INFRASTRUCTURE REPAIR AND NEIGHBORHOOD SERVICES MEASURE. To maintain 911 emergency response services; increase police, firefighter/paramedic staffing; repair potholes/streets; improve water supplies; and maintain general services; shall the City of Long Beach establish a one cent (1%) transactions and use (sales) tax for six years, generating approximately $48 million annually, declining to one half cent for four years and then ending, requiring a citizens' advisory committee and independent audits, with all funds remaining in Long Beach?" [emphasis added] That "audit" verbiage was included in the ballot label after Mayor Garcia made the following statement on Feb. 16 during the Council meeting (at which time the Council directed the City Attorney to prepare materials for Council approval that would place the measure on the ballot): "We will also as part of this, and as of any measure that would come before us, the City Auditor will also as part of this measure will also be conducting regular and routine annual looks and audits of what is happening with the funds, and so, that audit piece will also be part of it," Mayor Garcia said. A few weeks later, Mayor Garcia signed (as lead co-author) the official Rebuttal to the Argument Against Measure A, which told voters: "Measure A includes annual audits by our independent City Auditor." blog comments powered by Disqus Recommend LBREPORT.com to your Facebook friends:

Follow LBReport.com with:

Contact us: mail@LBReport.com |

Hardwood Floor Specialists Call (562) 422-2800 or (714) 836-7050  |