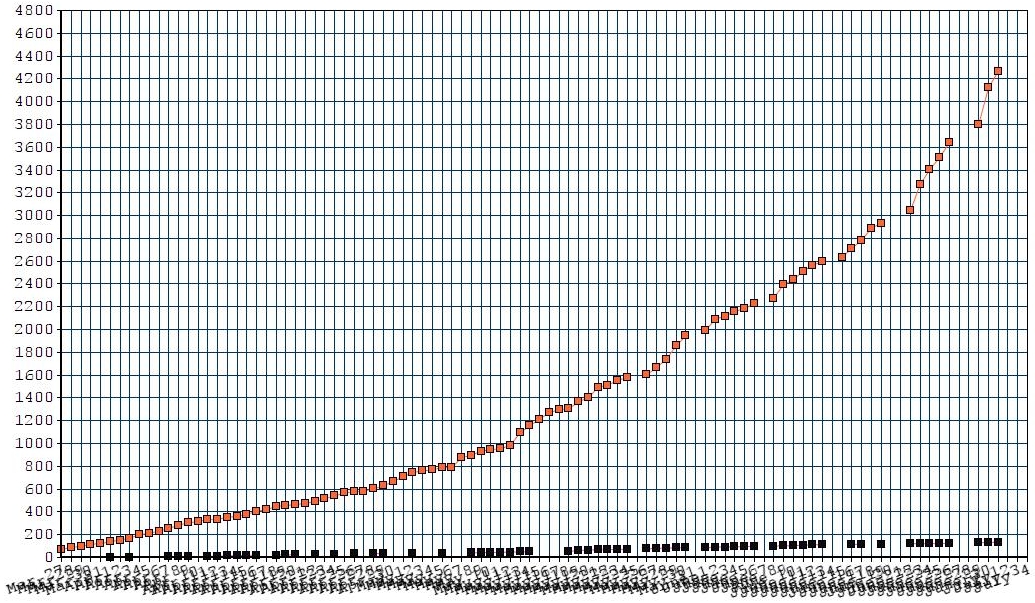

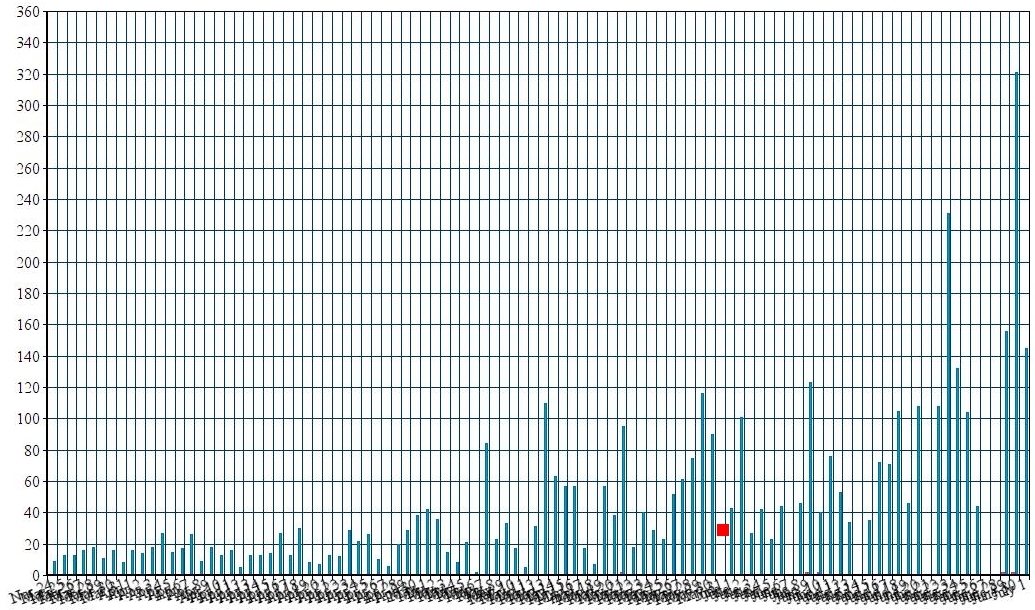

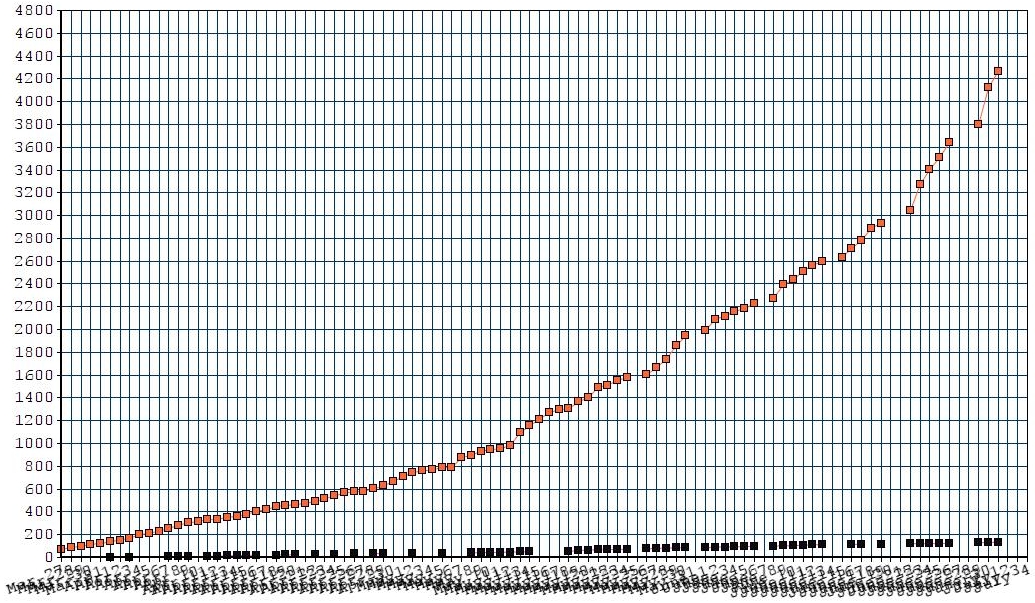

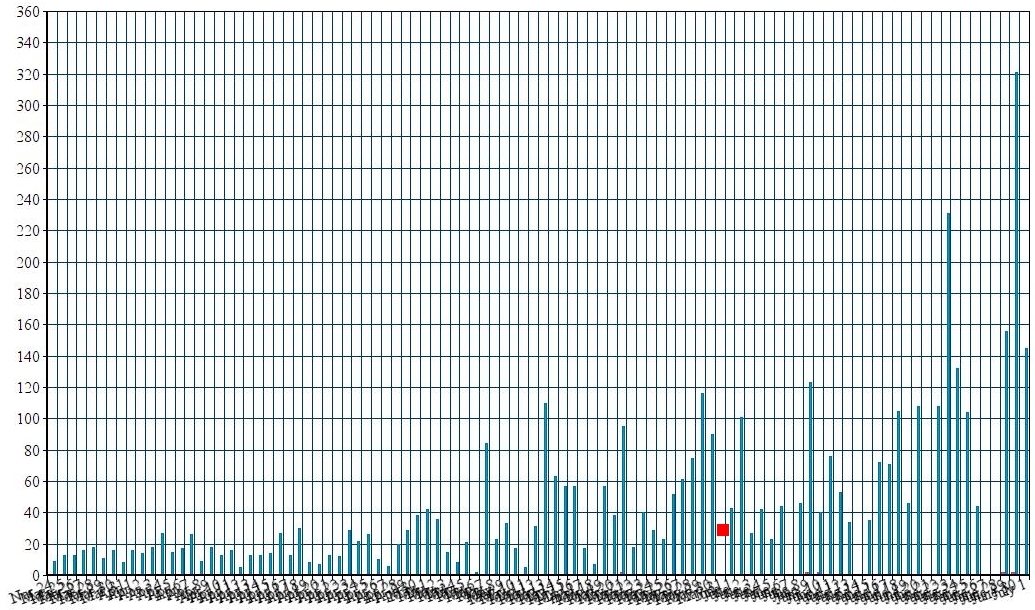

Total positives (red dots) and deaths (black dots) | Daily reported positive cases | Fast Face Mask: With Bandana/Woven Cloth + 2 Rubber Bands |

| (May 3, 2020, 3:15 p.m.) -- On May 5, city management will ask the City Council to approve two taxpayer impacting actions regarding LB's Aquarium. The agenda item provides an opportunity for Council incumbents to address overdue public openness and oversight issues that previous Mayors and Councils have allowed to persist in connection with the privately-run Aquarium operator that the City allows to run the publicly owned Aquarium facility. .

The agenda item seeks Council approval to loan $2.1 million to the non-profit corporation that the City has allowed to operate the Aquarium facility since 1998. The Aquarium operator is legally required to pay the City the $2.1 million sum by October 15 which would go into the City's Tidelands Operating Fund for debt service on 2012 Aquarium bonds. According to the agendizing memo, the Aquarium operator indicates that if the Governor and LB Health Dept. COVID-19 lift their closure orders soon enough and if attendance is adequate, it could have sufficient revenue to make the payment but "there's no assurance" of full payment. City management acknowledges that if the Council approves the $2.1 million loan, it will reduce Tidelands Operating Fund cash by $2.154 million and "an appropriation increase may be needed" [from currently unspecified sources] that management indicates it may bring to the Council at a future "appropriate" time. If the Aquarium operator doesn't make the required rent payment, management says the City will still have an obligation to pay the debt service on the bonds that the rent is intended to cover which would have the same net impact on the Tidelands Operating Fund as approving the loan...although with the loan the Aquarium operator wouldn't go into default. City management says the City and the operator "have an interest to avoid" a default and the operator's "relationship with the City is such that the Corporation [the operator] is extremely likely to make the payments [on the loan.]." [Scroll down for further.] |

|

The Aquarium operator also wants the City to accept $4.863 million in an advance payment of sums related to the Aquarium's "Pacific Visions" expansion. This would give City Hall immediate cash but risks future LB taxpayer exposure if the City chooses to spend all or part of the $4.8 million on any items other than making upcoming Aquarium bond payments; if that happens, LB taxpayers will be left holding the bag, exposed to pay those sums that the Aquarium was supposed to pay.

In the agendizing memo's Fiscal Impact statement, city management describes the LB taxpayer exposure as follows:: If the City lends money to the Corporation (up to $2,154,000) before October 15, 2020, this will reduce Tidelands Operating Fund Group cash and increase expenditures by $2,154,000. If this occurs, an appropriation increase may be needed, and a request would be brought to the City Council at the appropriate time. However, if the Corporation could not make the rent payment, the City would still have an obligation to pay the debt service on the bonds that the rent is intended to cover, which would have the same net impact on the Tidelands Operating Fund Group as the issuance of the loan. Either way, the impact is the same on the City, but in the case of the loan, the Corporation does not go into default as a result of the COVID-19 pandemic, something both the City and the Corporation have an interest to avoid. The loan is unsecured, but the relationship with the City is such that the Corporation is extremely likely to make the payments.

Unmentioned Aquarium Matters City management's agendizing memo doesn't mention some Aquarium related matters that LB taxpayers, and their voting Councilmembers, may wish to consider. The City's Aquarium operator -- Aquarium of the Pacific Corporation -- is a 501(c)(3) non-profit entity. Its Form 990 tax return for 2018 is publicly visible on the Aquarium's website at this link. It indicates that during 2018, the non-profit Aquarium operator paid its president/CEO, Dr. Jerry Schubel, $517.010 (base compensation of $367,630 plus $75,155 bonus/incentive compensation, plus other reportable compensation, retirement/deferred compensation and non-taxable benefits.). It's not public (yet) how much the Aquarium operator paid Dr. Schubel in 2019 (that year's 990 form isn't due yet) but in late 2019, he announced plans to retire in 2020. The 990 form indicates that in 2018, the non-profit Aquarium operator paid its VP of Finance/CF0 $236,234 (total compensation), its VP of operations $230,872 (total compensation), and four other senior staff members between $169,0024 and $189,943 each (total compensation for each.)

These sums were noteworthy in "normal" times when they received no meaningful City Council public oversight. Before asking LB taxpayers for a loan during COVID-19 conditions, have any of the non-profit Aquarium operator's six-figure staffers agreed to forego any of their pre-COVID compensation? Exactly who? How much? Effective when? Continuing for how long? And how might that reduce the $2.1 million sum now sought from taxpayers? As previously reported by LBREPORT,com, just weeks ago city management informed the Council and the public that the City faces multi-million dollar FY20 COVID-19 budget impacts, including a $6 million reduction in the Tidelands Operating Fund revenue from oil revenue alone...and that DOESN'T include the Aquarium issues. Management's April 13 memo to the Mayor/Council, attached to an April 21 Council agenda item, stated the following regarding the Tidelands Fund: "Not included in the [$6 million projected reduction is the potential loss of ancillary revenue used to pay the debt service on Tidelands bonds including the Aquarium, Queen Mary and Rainbow Harbor; potential problems with the debt service revenue for these bonds may significantly increase the adverse impact on Tidelands..." (with insufficient information at present to offer a numerical projection.) Despite several years of advocacy by LBREPORT.com, LB's past and present Councils have allowed the City's Aquarium operator to block public access to its governing board meetings and access to minutes of its previous meetings. [LBREPORY.com doesn't address here the separate issue of whether the Aquarium operator is already required under the Brown Act to allow public access to its meetings.] In responding to the Aquarium operator's May 5 request for the $2.1 million City loan, the City,Council could condition approval of that loan to the Aquarium board agreeing to permit public access to its governing board meetings and associated agendized written reports and minutes of the board's pervious actions. On January 21, 2014, in connection with a City Council Aquarium related agenda item, LBREPORY.com publisher Bill Pearl testified at the Council meeting and urged the Council to require the Aquarium's governing board to open its board meetings to the public and the press. That sparked Council discussion of the matter and then-Assistant City Manager Suzanne Frick offered to seek the Aquarium Board's position on the matter. [Her action diplomatically derailed a Council vote on the issue.] In May 2014, Ms. Frick indicated to LBREPORT.com that the Aquarium Board had expressed its view to her that it doesn't want the public or press present at its meetings.. During the 2018 tax filing period, the Aquarium operator's governing board included (and still includes) former LB Mayor Bob Foster (now heads a City Hall created "Economic Recovery Advisory Group") John Nolina (a co-founder of Pacific6 which through a subsidiary owns/operates "LBPost.com") and Dr. J. Mario Molina, MD (whose Twitter feed currently lists a location for him in South Pasadena.) A full list of the Aquarium operator's board members is listed on the Aquarium's website at this link. (With the exception of Dr. Schubel, the Aquarium's boardmembers are unapid.)

blog comments powered by Disqus Recommend LBREPORT.com to your Facebook friends:

Follow LBReport.com with:

Contact us: mail@LBReport.com |

|