Sacramento lawmakers enacted a statute prohibiting false or misleading ballot labels but wrote it in a way that requires a challenging plaintiff/petitioner to file a formal legal action and convince a judge that the ballot label text is false or misleading by "clear and convincing" evidence (a higher burden than the usual civil standard of "preponderance of the evidence.") In such a legal challenge, City Hall would also likely cite inclusion of the four words "and maintain general services" to defend its verbiage.

As with Measure A, the City Attorney's Nov. 19 agendizing memo says the Council may consider adopting a legally non-binding resolution of reciting its spending priorities for the tax. In June 2016, the Council adopted such a non-binding resolution for its original "temporary" Measure A sales tax. It told voters that it was the Council's intent to prioritize spending Measure A revenue for "the costs of providing public safety services, consisting of:police patrol, response, investigation, apprehension and law enforcement, emergency 9-1-1 response, fire prevention and suppression services, paramedic services, and ambulance services" [and] the costs of improving and maintaining streets, sidewalks and alleys, improving and upgrading the City's water system for conservation, and improving and upgrading storm water storm drain systems."

Since then, the Council has used Measure A revenue to restore 22 of 208 previously funded citywided deployable police officers, restore two fire engines (Engine 17 only with "one time" funds through FY21), one NLB paramedic rescue unit and fund various infrastructure projects and street repairs citywide. However as a General Fund revenue measure, Measure A also effectively frees up other General Fund sums for other City Hall spending (which has included new contracts with raises for LB's police and firefighter unions that provided much of the funding for the original Measure A campaign.)

City management has also indicated that if voters approve the March 2020 permanent Measure A sales tax extension, the City plans to tap a portion of Measure A General Funds funds to cover annual payments of $1 million to $2 million for up the next 15 years (among contract terms authorized by the Council earlier this year) for seismic upgrades enabling a privately-run for-profit LLC to open and operate a smaller version of Community Hospital on the City-owned seismically challenged site.

State law requires a unanimous Council vote to declare an "emergency" to enable a speical citywide election on the ballot measure earlier than the next regularly scheduled general election. The November 19 hotel room tax resolution presented for Council approval includes the following text:

WHEREAS, for the following reasons, the health, safety and general welfare of the citizens of the City would be endangered if the City were unable to place this Measure before its voters prior to November 3, 2020; and

WHEREAS, because operating costs continue to outpace City revenues, the City projects operating budget shortfalls starting in Fiscal Year 2020-2021; and

WHEREAS, these operating budget shortfalls may require reductions in public safety personnel, as well as street, facilities and infrastructure improvements; and

WHEREAS, as more specifically described by the City Manager to the Mayor and City Council on November 12,2019, it is estimated that the City has a backlog of infrastructure improvements totaling $2.3 billion, including pavement, alley, sidewalk and facilities investments, requiring a long-term funding source to fulfill these requirements; and

WHEREAS, the Long Beach Convention and Entertainment Center (Center) is an integral part of the City's economy and employment; and

WHEREAS, the City estimates that the Center requires at least $50,000,000 in capital improvements to maintain an acceptable level of service to the community; and

WHEREAS, absent additional revenues, current operating budget shortfalls will leave insufficient City funds to address capital improvements at the Center; and

WHEREAS, arts programs are important to the community, serving both youth and adults; and

WHEREAS, absent an additional revenue source, there are no identified sources of funding to continue these programs; and...

WHEREAS, in order to properly develop and decide on a budget for Fiscal Year 2020-2021, the City must know in advance whether or not Long Beach voters support a general purpose TOT rate increase. A March, 2020 special election will provide sufficient time for the City to incorporate the voters' decision into its budgeting calculations; and

WHEREAS, if the City were to wait until the November, 2020 General Municipal Election to place this question before Long Beach voters, the City would have to develop and approve a Fiscal year 2020-2021 budget without knowing the voters' wishes in this regard, compromising the City's ability to budget with full knowledge of all of its available revenue sources going forward; and

WHEREAS, the circumstances described above create an emergency situation warranting the placement of the Measure on a special election ballot to permit the voters to decide on the Measure pursuant to Proposition 218...

NOW, THEREFORE, the City Council of the City of Long Beach resolves as follows:

Section 1. Incorporation of Recitals. The foregoing recitals are true and correct and are hereby incorporated and made an operative part of this Resolution.

Declaration of Emergency/Calling of Election. Pursuant to California Constitution, Article XIIIC, Section 2(b), the City Council, by a unanimous vote, hereby declares the existence of an emergency in that there are imminent financial risks and dangers, as described above, to the public welfare and the City's financial ability to provide municipal services at current levels and without disruption, so that a special election is necessary to address such risks and dangers...

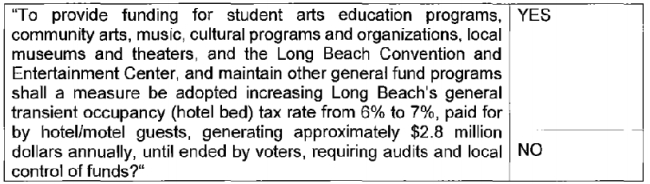

A city staff prepared Power Point presentation at the Nov. 12 Council meeting stated in one sentence on one slide that the "proposal is to increase the General Fund portion of the TOT tax by 1%" although multiple speakers for arts groups and Convention Center related entities stressed the narrative that the measure would provide funding for their desired projects. Mayor Garcia said at the time that the proposal to increase the General Fund portion of LB's hotel room tax for arts-related and Convention Center related items was brought to him by groups supporting that concept who'd signed a letter reciting their support.