|

County Proposed Parcel Tax ("Fee"): Unfair To Taxpayers, Harmful to Schools, Not Ready For Council Support As Written by Jenni Gomez * * Ms. Gomez is a homeowner and community advocate in Long Beach

|

|

|

County Proposed Parcel Tax ("Fee"): Unfair To Taxpayers, Harmful to Schools, Not Ready For Council Support As Written by Jenni Gomez * * Ms. Gomez is a homeowner and community advocate in Long Beach

|

|

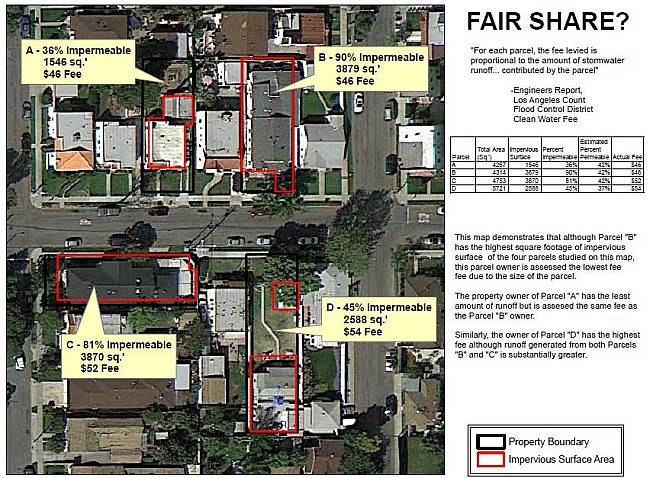

| (Jan. 8, 2013, 9:40 a.m.) -- I love clean water, including for our rivers and beaches. I believe it is our responsibility to reduce our impact on the planet and conserve our natural resources for future generations. Long Beach, especially as a coastal city, has a lot to benefit from the possibility of cleaner water. That said, I have a number of objections to an L.A. County Flood Control District staff-proposed "Clean Water Clean Beaches" parcel tax (that it calls a "fee"). Objection #1 Knabe is right Our own County Supervisor appropriately points out (click here) that the mailer regarding this proposed tax was very cleverly disguised as junk mail. I can't count the number of people I have asked who don't know anything about the Clean Water Fee because they threw the mailer away or never noticed it. Had the County chosen to send a formal letter with relevant information highlighted, this would not have happened. Knabe outright opposes this proposed fee for this reason alone. Objection #2, Reduced funding for education The Achilles Heal of this proposal, in my opinion, is not exempting our schools from paying this fee. Our schools are still severely under-funded and I can't imagine who thought it was a good idea to take more money away from our childrenís education. Our children need those educational resources -- with or without this tax/program -- to (among other things) tackle clean water issues and adapt and contend with a whole host of future environmental catastrophes. While California has made great strides improving water quality over the last 40 years, in contrast, the quality of education in our state has declined terribly. We have reduced property tax revenue for schools and the quality of our childrenís education continues to suffer. If we are to increase our property taxes so significantly, the schools should have some financial benefit, or at the very least, the tax should not continue to exacerbate the problem of our under-funded schools. Objection #3, Estimated "Fair share" This, apparently is where the sausage is really made. The legal basis of the fee is subject to the applicable requirements of Proposition 218 and several articles of the California Constitution. In order to comply, the fee must be "based on 'cost of service' which means that each property owner will pay a fee proportional to its 'fair share' of the cost of services implemented to improve water quality and paid for by the revenues from the fee." This means that each property owner will pay according to how much storm water runoff is produced from their own parcel. So, it is automatically assumed that your parcel produces a certain amount of storm water runoff and that it is dirty and must be cleaned. The amount of runoff per parcel is based on an accurate calculation of the parcel size, and it turns out a fairly inaccurate estimate each parcel's "impervious surface area." Impervious surface is the built area of the property: roof, concrete or other surface that acts as a barrier to rainwater soaking into the ground. A parcel is assigned an adjusted average percentage according to its land use; residential, commercial, industrial, etc. While this might suffice for an engineer figuring the capacity of a storm drain, the map titled "Fair Share" (below) shows that the tax proposed to be assessed on various parcels (as indicated) really doesn't reflect the relative cost of service. For this reason, I believe the legal basis of the tax is questionable as well.  Graphic by the author. Click to view pdf Objection #4, The Fee creates no incentive for property owners to reduce runoff or to ensure the runoff is less polluted. "An ounce of prevention is worth a pound of cure." If a fee/tax is to be imposed on residents for the purposes of cleaning storm water runoff, it should be implemented in such a way that it changes bad behavior. As this policy is written, there is zero incentive for anyone to reduce runoff from their property or to ensure that the runoff is less polluted. There is absolutely no mention of the fact that runoff from some properties is dirtier (or cleaner) than others. Do you practice organic gardening, have a rain barrel and never use lawn fertilizer? Well you have the same cost of service as the neighbors down the street who regularly throw their trash in the gutter, don't clean up after their dogs and spray weed and bug killer all over their properties. Question #1 Cleaner floodwater? Under Mayor Foster's failed Measure I proposal, 28 miles (!) of city storm drains were identified as being inadequate (not large enough) or in need of repair. While this County clean water measure says it will pay for "clean water" devices for catch basins such as smart sponges and filters, as far as I know it can't be used to improve our broken and inadequate storm drain system. This is very much like striping a bike lane on a street riddled with potholes. While we have dedicated grant funding for bikeways, the general fund suffers cuts each year and precludes proper maintenance of our infrastructure. Our inadequate storm drain system is already prone to flooding. What will the impact of these devices be on our already taxed and inadequate system? The city catch basins, as well as these clean water devices demand regular maintenance. Will ongoing maintenance of the clean water devices require any general fund revenue? If the devices aren't properly maintained, will they exacerbate our current flooding problems, or will we just have cleaner floodwater? Question #2 - What about the breakwater? The most important action we can take as a city to improve our beach and return it to a more natural state conducive to recreation, is to remove or reconfigure the breakwater! We need to bring waves back to our beach. Itís long overdue, and it sure would be nice if we could see waves crashing against our shore again in our lifetime. I don't know where we are in this process, but recently the federal budget problems were preventing progress on a required breakwater study. Could the City use Clean Water funds to accelerate the removal/reconfiguration of the breakwater? Would our city leaders actually choose to do this if they are able? Conclusion For all these reasons, I believe it would be ill-advised for the Long Beach City Council to leap tonight at supporting the poorly written tax ("fee") that Councilmembers Suja Lowenthal and Steven Neal propose to endorse as written. The Council needs to listen first before racing to endorse a measure that as written is unfair to taxpayers, harmful to schools and may not produce the results it promises.

Contact us: mail@LBReport.com |

Hardwood Floor Specialists Call (562) 422-2800 or (714) 836-7050  |

Contact us: mail@LBReport.com